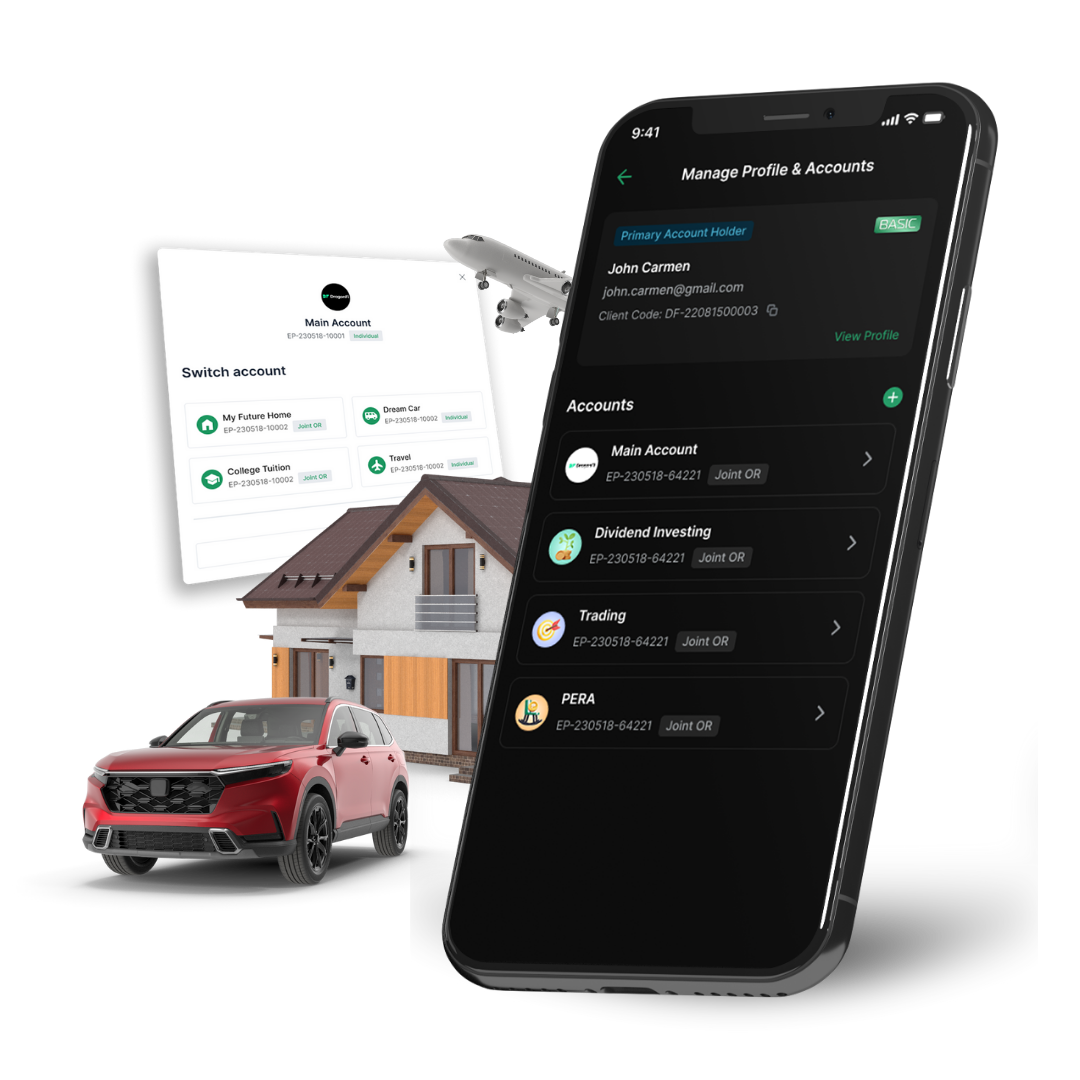

One Login,

Multiple Possibilities.

We get it—one account isn't enough. You're investing for different goals, people, and timelines. We help you keep it all organized, your way.

One Life, Many Dreams.

We get it—one account isn't enough. You're investing for different goals, people, and timelines. We help you keep it all organized, your way.

Dream Home

Keep property savings separate from trading. Stay focused on long-term goals.

Education Fund

Track education savings clearly. Adjust strategies as timelines and tuition change.

PERA Coming Soon

Build a retirement portfolio. Stay aggressive or conservative without overlap.

Next Adventure

Set aside funds for travel—without touching your main portfolio.

Business

Separate personal and business investments. Stay organized and tax-efficient.

Family

Manage investments for family—and keep everything structured and clear.

Why split when you can conquer?

Multiple accounts aren't just organized—they're strategic. Here's why they make all the difference.

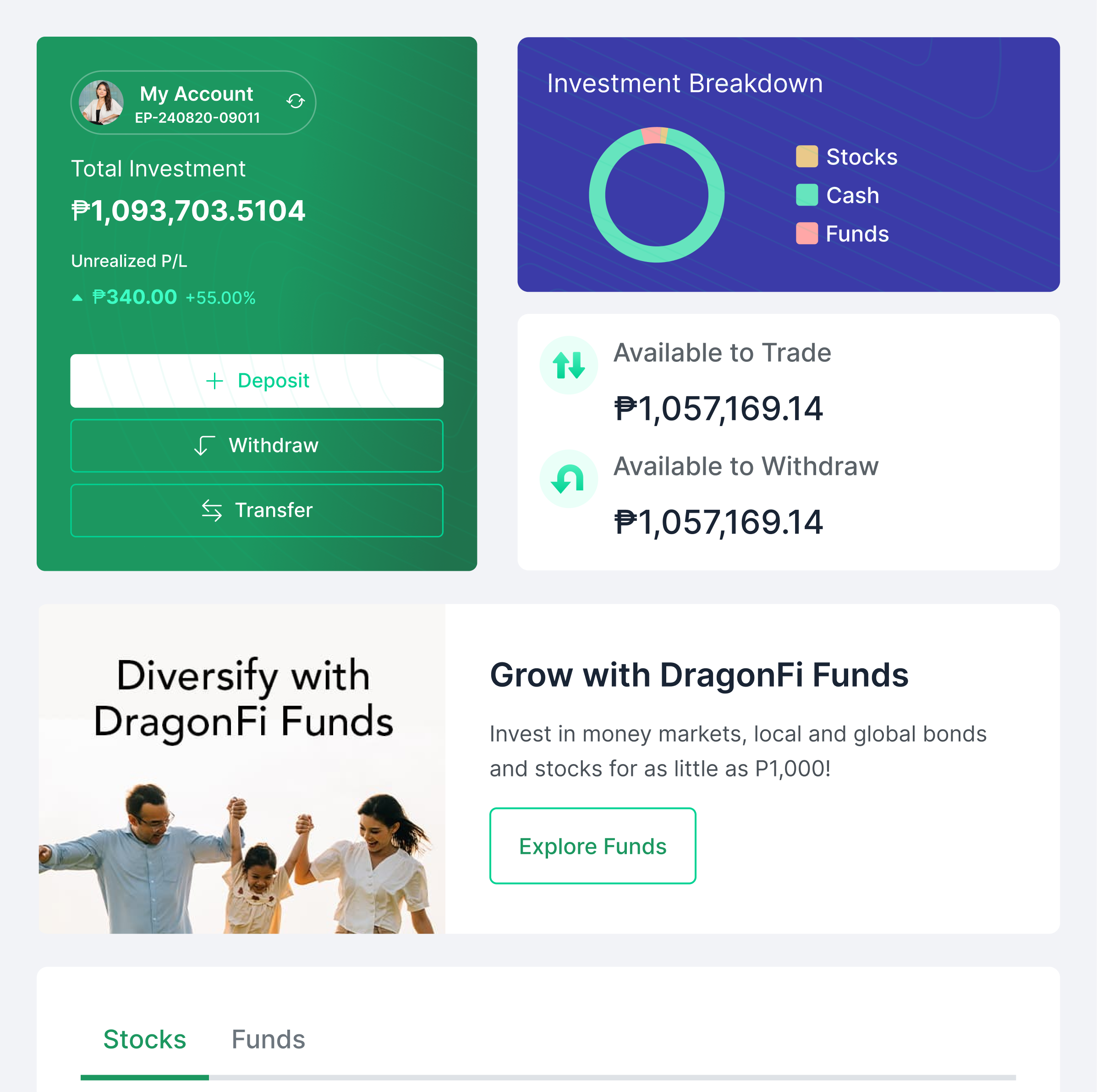

See the whole picture, clearly

No more guessing how much is saved for what. Each goal stands on its own.

Know what's working (and what's not)

Easily track how each strategy is doing—without the clutter.

Take calculated risks, where it makes sense

Go bold with long-term goals, play it safe with near-term needs.

Keep your future self protected

Separate funds mean you're less tempted to dip into your long-term savings.

4 Steps to Financial Clarity

We've made it super easy to organize your money and stay on top of your goals.

Name your dream

Name it something that excites you—like "Beach Fund," "MBA Dream," or "Early Retirement.

Create an account

Open a separate account just for this goal—no mix-ups, no mental math, just clean tracking.

Fund your future

Top up your account whenever it works for you—whether it's a big deposit or a small one, it all adds up.

Watch it grow

It's easier to stay focused when each goal has its own account. You'll always know where you stand.

Navigating Multiple Accounts is Effortless

Learn how to create, switch, and organize your investments with just a few taps.

Watch the full tutorial

2:59 minutes

Latest Insights

Stay updated with our latest articles, tips, and market insights.

Our newest Upgrade is here! Multiple Accounts has arrived

One Log-in. Multiple Possibilities

Multiple Strategies need Multiple Accounts

Optimize your portfolio's returns with multiple accounts

Ready to organize your financial future?

It takes less than 2 minutes to create your first set of accounts and start investing with purpose.

Got Questions?

We've got answers.

Everything you need to know about managing multiple investment accounts.

You can create up to four (4) accounts under one DragonFi login. We offer flexible setups depending on your needs:

- Basic – 1 account

- Starter – 2 accounts

- Prime – 4 accounts

Choose the setup that fits your goals, and easily manage multiple portfolios all in one place.

There's no additional minimum balance requirement for creating multiple accounts. However, standard funding and trading rules apply to each account.

Yes, transfers are permitted between joint accounts provided they share the same beneficiary. This requirement helps maintain consistency in account ownership and ensures secure fund movement.

No. The Multiple Accounts feature is completely free for DragonFi users.